Did you know the State of California is currently holding $8 billion in unclaimed funds in the names of more than 30 million individuals and organizations? I was one of them until a few weeks ago, when I went searching for missing money. The law requires companies to turn over funds after three years or more if there hasn’t been any activity or contact with the rightful owner.

Did you know the State of California is currently holding $8 billion in unclaimed funds in the names of more than 30 million individuals and organizations? I was one of them until a few weeks ago, when I went searching for missing money. The law requires companies to turn over funds after three years or more if there hasn’t been any activity or contact with the rightful owner.

What motivated me was my sister-in-law posting on Facebook about her successes tracking down unclaimed funds in a variety of states where she and her husband have lived over the past 30 years. He found $144 from the State of Washington dating back to his college days, and she discovered she was entitled to almost $600 from old bonds and mutual funds that had belonged to her now-deceased parents.

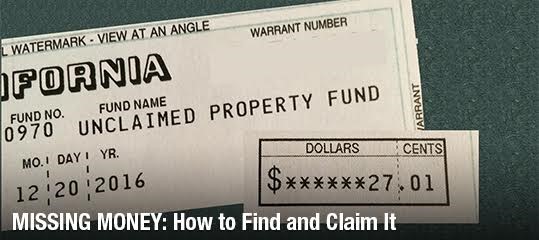

My search started with the State of California’s Division of Unclaimed Property (ucpi.sco.ca.gov/UCP). To access the database, the only information you need is your last name, but it’s easier to find the correct matches if you add your first and middle names and city. I found three different items totaling almost $90. The State makes it easy to claim most funds by filing an e-claim. I received mine in about three weeks.

I did other searches for myself and other family members in all the states where we’ve lived, but nothing turned up (money is held in the state where the account was located). Every state has slightly different processes, and you must provide more documentation for some kinds of claims. For example, depending on the type of claim you’re making, you might have to send in a marriage certificate, birth certificate or death certificate. Here’s a website that helps you find money by using a national database that includes many states (but not California): www.missingmoney.com/Main/StateSites.cfm.

According to the National Association of Unclaimed Property Administrators, some common forms of unclaimed property include savings or checking accounts, stocks, uncashed dividends or payroll checks, refunds, traveler’s checks, trust distributions, unredeemed money orders or gift certificates (in some states), insurance payments or refunds and life insurance policies, annuities, certificates of deposit, customer overpayments, and utility security deposits.

You should also know that while some companies advertise that they can help you find unclaimed funds in your name for a fee, it’s free and easy to do it yourself.

One Response

Leave a Reply

You must be logged in to post a comment.

Make sure to check for money every once in a while. The unclaimed property is reported on a regular yearly cycle that takes quite a while to process.

Be persistent too. California receives several hundred thousand requests for money (400-500 thousand annually if I recall correctly) and the laws can be complicated too so you can at times get lost in all the “shuffle”.

Feel free to reach out to their Property Owner Advocates if you are not having much success going the normal route.